Setting Up Accounting and Invoicing

Part 1: Setting Up your company and taxes

Nkosikhona Carlos

Last Update 4 years ago

Prys Accounting is known for its reach accounting features inherited from Odoo 10 which come standard and equipped with features for small and growing African businesses.

on your first day you will need to setup and review different setting like Bank Accounts, Tax and VAT settings.

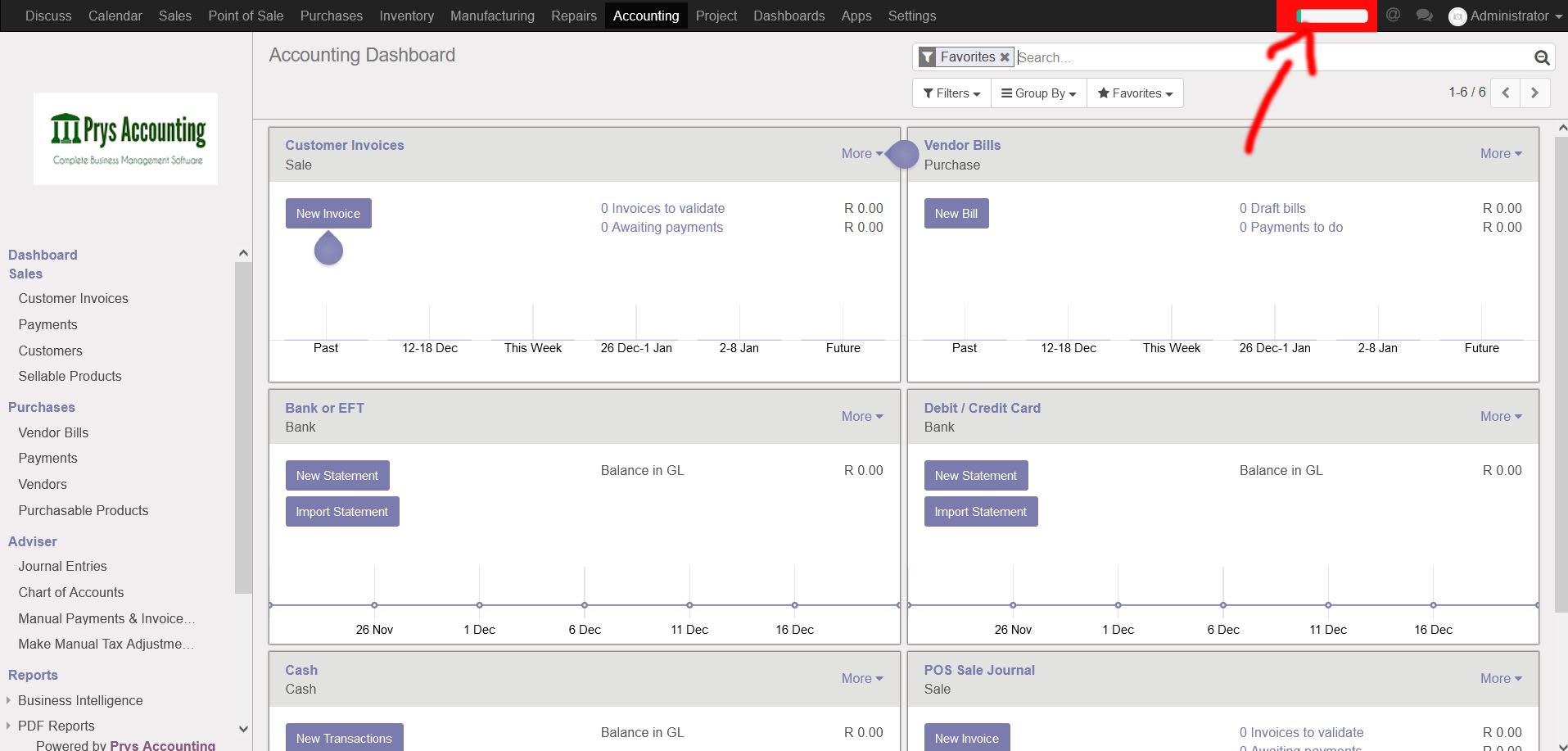

The easiest way to do this is to use the built in guide follow the red arrow below.

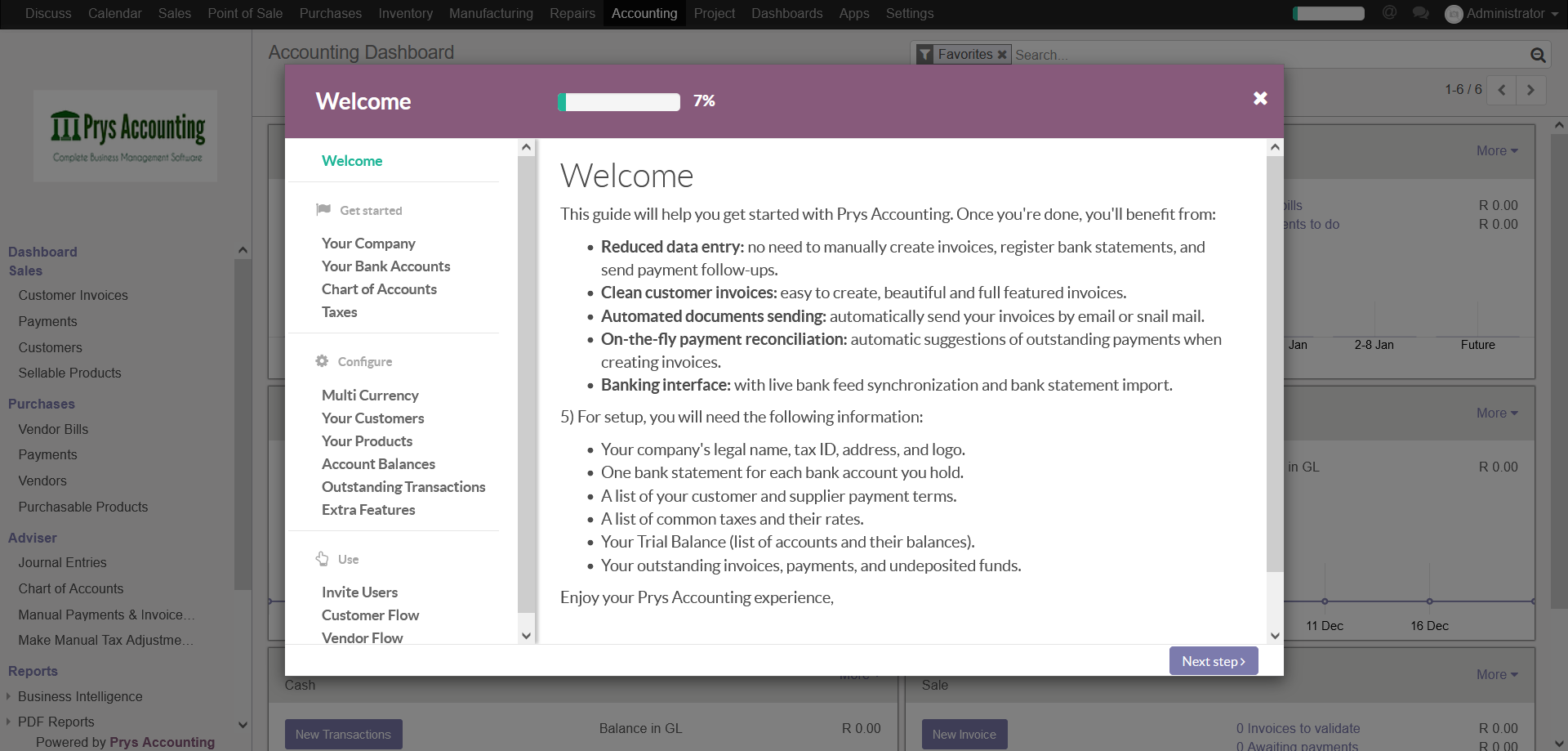

This action will open a Pop Up Window like the one below.

Using the Menu on the left hand side you will be able to

1. Edit Company Details and Logo

2. Set your Bank Account number so they appear on Quotations, Invoices and Sales Orders

3. Chart of Accounts: This feature is already setup from the box we do not recommend changing accounts as this might affect reports and functionality of the software. However for accountants and financial administrators, you may setup and rename different accounts for personalized reports.

4. Taxes, you need to set up for VAT or remove VAT from your Invoices. Click on Taxes, Close the POP up window to reveal the default taxes. Click and open the Tax row you wish to edit, and click on edit at the top left corner. Make sure to edit the amount to indicate how much tax is charged per customer. Standard VAT is 15% so you will enter 15 on the *amount* field. if you do not charge VAT you will enter 0 on the amount field. Navigate to *Advanced Options* tab to select if your price includes taxes or not. This is very important as it sets how your invoices are formatted and how Tax is handled by the ERP software.

5. General terms and conditions: These are your sales term i.e: "No refunds after 7 days of purchase"

Remember you may access this guide at any point by click on the green/white bar next to your username (Top Right)